Amid Sharp Drop in International Development Aid, Stronger Tax Administration Can Help Fill Funding Gap for Sustainable Development, Speakers Tells Round Table

Press UN

30 Jun 2025, 18:50 GMT+10

SEVILLA, SPAIN (30 June) — In the first of six multistakeholder round tables to be held alongside the plenary meetings of the fourth International Conference on Financing for Development, speakers in Sevilla today urged that strengthened tax administration can provide at least some of the resources necessary to fund sustainable development amidst a sharp decline in international development aid.

Held this afternoon, today’s roundtable discussion centred on mobilizing and aligning domestic public resources. In opening remarks, Amina J. Mohammed, Deputy Secretary-General of the United Nations, said that — amid falling aid budgets — the international community must work to reform the development-cooperation architecture and “shift from development assistance to investing in development”. Further, States must support global trade as an engine of development and reform for the international financial architecture to be just, effective and inclusive. “I look forward to the discussions that follow,” she said.

Next, Co-Chair Alar Karis, President of Estonia, said that his country offers a “valuable example of how strategic governance, digitalization and innovation” can mobilize domestic resources and ensure their efficient use for sustainable development. Estonia, he reported, has implemented efficient tax systems and digital public services to minimize leakage and improve transparency. “Around 98 per cent of all tax declarations in Estonia are filed electronically,” he reported, adding that “our experience proves that transparent and efficient tax administration” encourages voluntary compliance and boosts tax morale — which results in increased revenues.

More Sustainable, Equitable Domestic Resource Mobilization Crucial to Alleviate Debt Burden, Shore up Economies

His fellow Co-Chair, Mohamed Juldeh Jalloh, Vice-President of Sierra Leone, then stated: “The hard truth is this — traditional sources of financing, such as official development assistance (ODA) and foreign direct investment, have proven insufficient.” This is therefore a “wake-up call”, he said, to mobilize domestic resources more sustainably and equitably. To that end, Sierra Leone is working to harmonize trade policies and foster regional value chains in West Africa. He urged those present: “Let us not allow this conference to become another moment of diagnosis.” Rather, the conversation must shift “from dependence to dignity, from fragmentation to alignment, from pledges to performance”, he urged.

Denys Shmyhal, Prime Minister of Ukraine, then delivered a keynote address, thanking those whose support allowed his Government to maintain social safety nets, fund education and healthcare, support displaced people and restore critical infrastructure damaged by the Russian Federation’s attacks. He spotlighted countries’ struggle with unsustainable debt levels, adding: “Ukraine knows this not in theory, but through painful experience.” Ukraine has been forced to borrow on an “extraordinary” scale just to protect lives and meet basic needs under the fire of aggression, he said. And, while Ukraine fights to defend its people, territory, Europe’s borders and the principles of the UN Charter, he stressed that “the cost is economic exhaustion”.

Then, Daniel Noboa Azin, President of Ecuador, asked how best to “coordinate, mobilize, convince and drive forward a group of people in order to follow a plan”. Ecuador is changing, he said, “largely because we have been able to mobilize these human resources to ensure that the entire country aligns towards a better future”. Adding that “the era of ideologies is over”, he said that today’s youth are “looking for ways of working with no strings attached”. He also stressed that it is hope — more than anything else — that “sustains us, driving us all towards the same North Star”. “This is what will allow the building of a better future,” he said.

Creating Fiscal Space Needed for Sustainable Growth through More Efficient, Fair Tax Systems

The round table then engaged in a panel discussion. Moderated by Gilbert F. Houngbo, Director-General of the International Labour Organization (ILO), it reflected on what reforms and investments are most urgent; how to strengthen tax cooperation and transparency; and how to unleash the full potential of public development banks.

First, it heard from José Manuel Albares Bueno, Minister for Foreign Affairs, European Union and International Cooperation of Spain, who stressed that more efficient, fairer tax systems are “necessary to build the fiscal space that will allow countries to invest in their own sustainable development”. To that end, Spain is working to promote international cooperation to achieve minimum taxation on large fortunes, improve integrity and transparency in taxation and strengthen efforts to avoid and combat illicit financial flows. “Our goal must be to increase the resources available to finance sustainable development,” he said.

Also underlining the need for international fiscal cooperation and the redirecting of wealth through investment in public goods like health, education and social protection, he reported that Spain is committed to active, constructive participation in the UN Framework Convention on International Tax Cooperation. It also works to promote dialogue concerning the reform of tax systems in Latin America and the Caribbean. He also underscored that the international community must work to reduce socioeconomic gaps around the world: “This is the only way we can advance the idea of justice to leave no citizen behind.”

Next, Reem Alabali Radovan, Minister for Economic Cooperation and Development of Germany, underscored that domestic resource mobilization is key to reducing inequality and financing sustainable development. “Governments need sufficient fiscal space to fight poverty and invest in public goods,” she stressed, reporting that her country is supporting over 30 partner countries towards this end. Noting that research shows that strengthening tax policies and administration is “one of the most cost-effective investments in development cooperation”, she emphasized that every $1 invested in this way results in a four-fold increase in domestic funds.

This, she pointed out, is especially important during a time in which many countries are cutting their ODA budgets. Calling on all stakeholders to contribute to collective efforts to strengthen tax cooperation, she urged: “Together, we must ensure that everybody — including multinational corporations and the super-rich — pay their fair share.” She added that the Sevilla Commitment addresses this as “an agreement that underscores our commitment to international cooperation, solidarity and justice that will drive multilateral cooperation forward”.

Focus on Mechanisms to Counter Tax Evasion, Illicit Financial Flows

Offering national examples of efforts to counter tax evasion and illicit financial flows, Cheikh Diba, Minister for Finance and Budget of Senegal, detailed mechanisms to combat tax fraud and to audit in cases involving “heightened risks”, such as hydrocarbons, mines and the digital economy. Additionally, Senegal has updated its legislation to counter money-laundering and will work at the administrative level to update and digitize its taxation system. He, too, expressed support for the UN Framework Convention on International Tax Cooperation, “which could help us break the impasse on this issue” and ensure that multinational businesses pay a minimum amount of tax in each of the countries where they operate.

Rounding out the panel was Nigel Clarke, Deputy Managing Director of the International Monetary Fund (IMF), who recalled that he served as Jamaica’s Minister for Finance before joining IMF. He did so during “some of the most turbulent years in recent memory”, he noted, emphasizing that this shaped his view on revenue capacity as “the crucial financial enabler of State capacity”. Observing that “development is not funded by hope”, he underscored: “Sound public finances are essential to safeguard macroeconomic stability and lay the foundations for sustained growth.”

Higher Economic Growth through Taxation of at Least 11 to 15 Per Cent of Gross Domestic Product (GDP)

However, he said that — across much of the world — increases in tax capacity have slowed, productive expenditure is crowded out by rising debt service and spending pressures are intensifying. “The key to progress,” he stressed, “lies in country-led reform agendas that focus on building trust, taxing fairly and spending wisely”. According to IMF research, there is a tipping point of tax-to-gross-domestic-product (GDP) that, once crossed, leads to higher sustained economic growth. While the right level of taxation will depend on each country’s socioeconomic circumstances, IMF research suggests that targeting at least 11 to 15 per cent of GDP is best. “Revenue capacity is the ultimate foundation of national resilience,” he said.

Global Network of 530 Public Development Banks ‘Work Better as a System’

The round table also heard from Nadia Calvino, President of the European Investment Bank, who noted that there are 530 public development banks in the world. “This is a very strong network,” she emphasized, adding that multilateral development banks are increasingly trying to “work better as a system”. To that end, she noted that her bank has just recently signed memoranda of understanding with two development banks located in Latin America. She said: “There is merit in trying to see how we can leverage each other’s expertise and financial capacity to maximize impact on the ground.”

Yang Yingming, Vice-President of the Asian Development Bank, then pointed to the need to provide targeted support to enhance tax capacity; to promote international tax cooperation to tackle cross-border challenges; and to increase timely multilateral support to help countries navigate the challenges from increasingly digitized economies. In that vein, he detailed his bank’s efforts to help South-East Asian countries strengthen domestic-resource mobilization by, inter alia, implementing international tax transparency.

Increasing Self-Reliance, Resiliency through Domestic Resource Mobilization

Summing up the “overarching” message advanced in today’s round table, he concluded: “Domestic resource mobilization is essential for countries to be more self-reliant and resilient.”

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Sierra Leone Times news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Sierra Leone Times.

More InformationBusiness

SectionCanadian tax on US tech giants dropped after Trump fury

WASHINGTON, D.C.: On Friday, President Donald Trump announced that he was halting trade discussions with Canada due to its decision...

Trump-backed crypto project gets $100 million boost from UAE fund

LONDON, U.K.: A little-known investment fund based in the United Arab Emirates has emerged as the most prominent public backer of U.S....

DIY weight-loss drug trend surges amid high prices, low access

SAN FRANCISCO, California: Across the U.S., a growing number of people are taking obesity treatment into their own hands — literally....

Apple allows outside payment links under EU pressure

SAN FRANCISCO, California: Under pressure from European regulators, Apple has revamped its App Store policies in the EU, introducing...

Euro, pound surge as U.S. rate cut odds grow after Powell hint

NEW YORK CITY, New York: The U.S. dollar tumbled this week, hitting its lowest levels since 2021 against the euro, British pound, and...

Sam’s Club fulfillment center to shut in Texas, jobs impacted

NEW YORK CITY, New York: Walmart is set to close a major Sam's Club fulfillment center in Fort Worth, Texas, as part of a shift in...

Africa

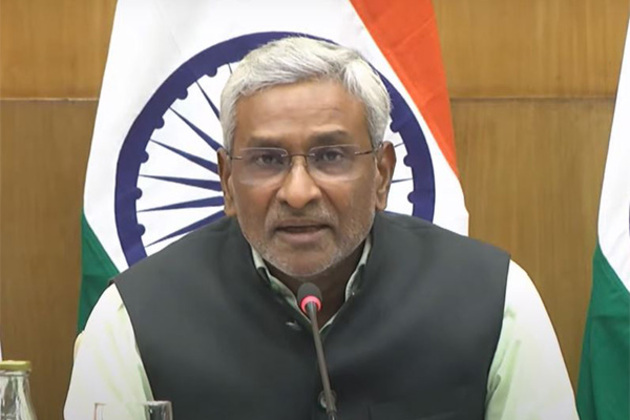

Section"India has significant role to play this time": BRICS chairman hails PM Modi's initiatives

New Delhi [India], June 30 (ANI): Harvansh Chawla, Chairman of the BRICS Chamber of Commerce and Industry, highlighted India's importance...

Brazil keen on defence collaboration with India, interested in Akash Air defence system, Garuda artillery guns: MEA

New Delhi [India], June 30 (ANI): The Ministry of External Affairs (MEA) on Monday highlighted that Brazil has expressed significant...

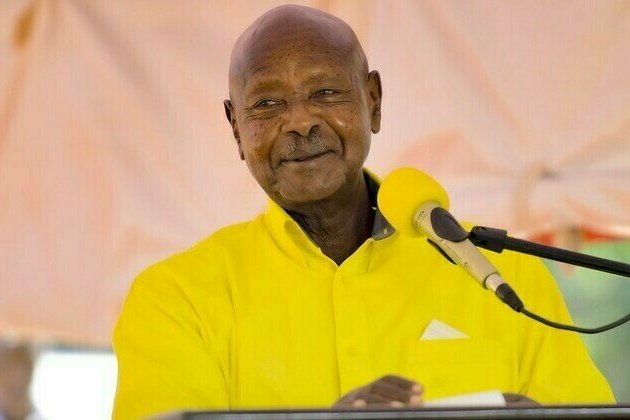

Vocal critic of West seeks reelection as Ugandan leader

Yoweri Museveni has led the African nation for decades after first coming into power in 1986 Ugandan President Yoweri Museveni has...

Apple Music partially restores sanctioned Russian artists

The platform has brought back the profiles of the likes of Shaman and Polina Gagarina Apple Music streaming service has restored...

PM Modi set to attend BRICS Summit in Brazil's Rio, focus on strengthening Global South cooperation

New Delhi [India], June 30 (ANI): Prime Minister Narendra Modi is set to embark on a multi-nation visit to Ghana, Trinidad and Tobago,...

PM Modi's 5-nation visit: Vaccine development among focus items in Ghana; discussions in Namibia to touch on UPI expansion

New Delhi [India], June 30 (ANI): Prime Minister Narendra Modi's upcoming five-nation tour, beginning on July 2, will see significant...